Michael L. Tushman

Paul R. Lawrence MBA Class of 1942 Professor of Business Administration

Michael Tushman holds degrees from Northeastern University (B.S.E.E.), Cornell University (M.S.), and the Sloan School of Management at M.I.T. (Ph.D.). Tushman was on the faculty of the Graduate School of Business, Columbia University, from 1976 to 1998 where he was the Phillip Hettleman Professor of Business from 1989 to 1998. He has also been a visiting professor at MIT (1982, 1996) and INSEAD (1995-1998, 2011).

Tushman was awarded the Academy of Management’s Career Achievement Award for

Distinguished Scholarly Contributions to Management (2013) and received an

honorary doctorate from the University of Geneva (2008). Tushman received

distinguished scholar awards in the Technology and Innovation Management

(1999), Organization Management and Theory (2003), and Organization

Development and Change (2016) Divisions of the Academy of Management. He was

elected Fellow of the Academy of Management (1996). Tushman received the

distinguished scholar award at INFORMS’ Technology Management Section (2010)

and was recognized as a Foundational Scholar in the Knowledge and Innovation

Group of the Strategic Management Society (2014).

Rohit Deshpande

Sebastian S. Kresge Professor of Marketing

Rohit Deshpandé is Sebastian S. Kresge Professor of Marketing at Harvard Business School, where he has been teaching in the Program for Leadership Development, the Owner/President Management Program and in other executive education offerings. He has also taught global branding, international marketing, and first year marketing in the MBA program as well as a doctoral seminar in marketing management. He is the faculty chair of the Global Colloquium for Participant-Centered Learning and coordinator for Marketing faculty recruiting, and has previously been coordinator for Marketing doctoral program admissions, and faculty chair of the Strategic Marketing Management executive program at Harvard Business School. In addition to teaching marketing, he was a part of the design and delivery team that created the Leadership and Corporate Accountability (LCA) MBA required course at HBS focusing on ethics and corporate governance and was faculty chair of the LCA in India executive program. In 2008-2009 Deshpande was recognized as the Henry B. Arthur Fellow for Business Ethics and in 2015 received the Robert F. Greenhill award for outstanding contributions to the HBS community.

John T. Gourville

Albert J. Weatherhead, Jr. Professor of Business Administration

John Gourville is the Albert J. Weatherhead, Jr. Professor of Business Administration at the Harvard Business School. He joined the HBS Marketing Unit in 1995 after receiving his Ph.D. at the University of Chicago in marketing and behavioral research. He has recently returned to teaching in the Core Marketing course in the first year of the MBA program, a course for which he had previouosly been course head. He has also taught the electives The Marketing of Innovations, Consumer Marketing, and Entrepreneurial Marketing in the second year of the MBA program. In the HBS Executive Education program, he has chaired the Strategic Marketing Management program. He also teaches in the Aligning Sales and Strategy program and the Program for Leadership Development, as well as a number of custom company programs. John also has participated in specialized executive education programs throughout the world. Prior to receiving his Ph.D., John held management positions with Booz, Allen & Hamilton, Mobil Oil, and New York Telephone.

Tarun Khanna

Jorge Paulo Lemann Professor

Tarun Khanna is the Jorge Paulo Lemann Professor at the Harvard Business School, where he has sought for two decades to study the drivers of entrepreneurship in emerging markets as a means of economic and social development. At HBS since 1993, after obtaining degrees from Princeton and Harvard, he has taught courses on strategy, corporate governance and international business to MBA and Ph.D. students and senior executives. For many years, he has served as the Faculty Chair for HBS activities in India and South Asia.

A summary of his work on emerging markets appeared in his 2010 co-authored

book, Winning in Emerging Markets, and an example of his comparative work on

entrepreneurship appears in his 2008 first-person analysis of China and

India, Billions of Entrepreneurs, both published by Harvard Business Press

and translated into many languages. In 2014, his piece, Contextual

Intelligence, was a runner-up for the McKinsey Prize for the year’s best

article in the Harvard Business Review.

Kathleen L. McGinn

Cahners-Rabb Professor of Business Administration

Kathleen L. McGinn is the Cahners-Rabb Professor of Business Administration at Harvard Business School. Professor McGinn studies the role of gender at work, at home, and in negotiations. Her current field research investigates these issues internationally—in families across 34 countries, in organizations and communities in Mexico and India, among women “firsts” and female professionals in North America, and in relation to health and welfare outcomes for young women in Zambia. She previously served as Harvard Business School’s Senior Associate Dean for Faculty Development, Director of Research, and Chair of Doctoral Programs.

Professor McGinn advises organizations in the areas of negotiation, gender

and employment relations. She chairs the board for CFK Inc. (US & Kenya) and

is a member of the board for WAVE (US & Nigeria). Before coming to Harvard,

Professor McGinn taught at Cornell University’s Johnson School and

Northwestern University’s Kellogg Graduate School of Management, where she

received her Ph.D. Prior to her academic career, Professor McGinn was a

director of labor relations in the public sector.

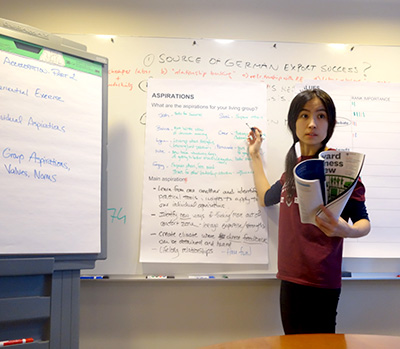

Tsedal Neeley

Associate Professor of Business Administration

Tsedal Neeley (@tsedal) is an associate professor in the Organizational Behavior unit at the Harvard Business School. She has taught in both the MBA (LEAD, Leading Teams in a Global Economy, Field Global Immersion) and in various executive education programs such as Global Strategic Management. She currently teaches in the Executive Education offering “Program for Leadership Development.” Professor Neeley is a recipient of the HBS Charles M. Williams award for outstanding teaching in Executive Education.

Gary P. Pisano

Harry E. Figgie, Jr. Professor of Business Administration

Gary Pisano is the Harry E. Figgie Professor of Business Administration at the Harvard Business School. He has been on the Harvard faculty since 1988. Pisano’s research, teaching, and consulting have focused on technology strategy, the management of innovation and intellectual property, competitive strategy, and manufacturing and outsourcing strategy. His work on these issues spans a range of science and technology based industries including aerospace, biotechnology and pharmaceuticals, specialty chemicals, health care, nutrition, computers, software, telecommunications, and semiconductors.

Eugene F. Soltes

Jakurski Family Associate Professor of Business Administration

Eugene Soltes is the Jakurski Family Associate Professor of Business Administration at Harvard Business School where his research focuses on corporate misconduct and fraud, and how organizations design cultures and compliance systems to confront these challenges. He teaches in several of the school’s executive education programs and was the recipient of the Charles M. Williams Award for outstanding teaching.

J. Gunnar Trumbull

Philip Caldwell Professor of Business Administration

Gunnar Trumbull is a Professor at the Harvard Business School, where he teaches in the Business, Government, and the International Economy area. Trumbull graduated from Harvard College in 1991 and earned a Ph.D. in political science from M.I.T. in 2000. He joined the Harvard Business School faculty in 2001, where his research focuses on European political economy.

Bharat N. Anand

Henry R. Byers Professor of Business Administration

Bharat Anand is the Henry R. Byers Professor of Business Administration in the Strategy Unit at Harvard Business School, and the faculty chair of the HBX initiative. He also serves on the university's HarvardX Faculty Committee. His research is in applied and empirical industrial organization, and examines competition in information goods markets, with a primary focus on media and entertainment. He is also an expert in multi-business strategy. He chairs several executive education programs, including the school's executive education program on media strategies. He received an AB in Economics, magna cum laude, from Harvard University, and his PhD in Economics from Princeton University, where he was nominated to the Princeton Junior Society of Fellows.